Where To File Comlaints Against A Credit Card Companys Poor Customer Service

ValuePenguin studied the credit carte complaints database at the Consumer Fiscal Protection Bureau (CFPB) to provide insights into the most pregnant credit card problems facing today's consumers. From the xiii,000+ complaints nerveless by the CFPB in 2013, below are our key findings on the most satisfied customers, the most complained virtually bug, and the complaint types with the highest refund rates.

Study Highlights

What credit card customers had the most satisfied customers based on complaints?

- American Limited and Hunt rated highest in customer satisfaction, with the least complaints relative to the book of purchases fabricated.

- Of the top half-dozen credit card companies in the United States, Capital One and Citibank were the worst ranked in our measure of customer satisfaction.

- While Majuscule 1 and Citi scored worst among these companies on our complaint measure out, they were also the most likely to resolve complaints by issuing a refund or credit (33% of cases)

- Bank of America was the to the lowest degree likely to resolve complaint cases with some sort of financial compensation.

What practise consumers complain nigh?

- Cardmembers' biggest issues were billing disputes, account closures, and fraud (including identity theft and embezzlement)

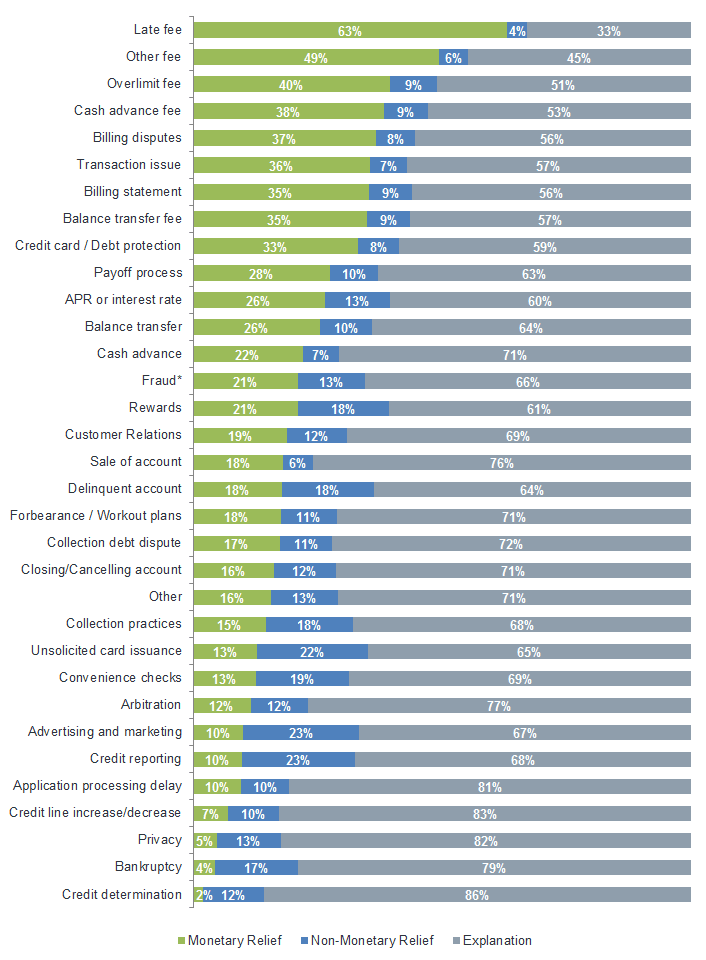

- Consumers that complained to the CFPB about tardily fees were the nearly likely to receive financial bounty, with 63% of complaints addressed in this way.

Who complains the about about credit cards?

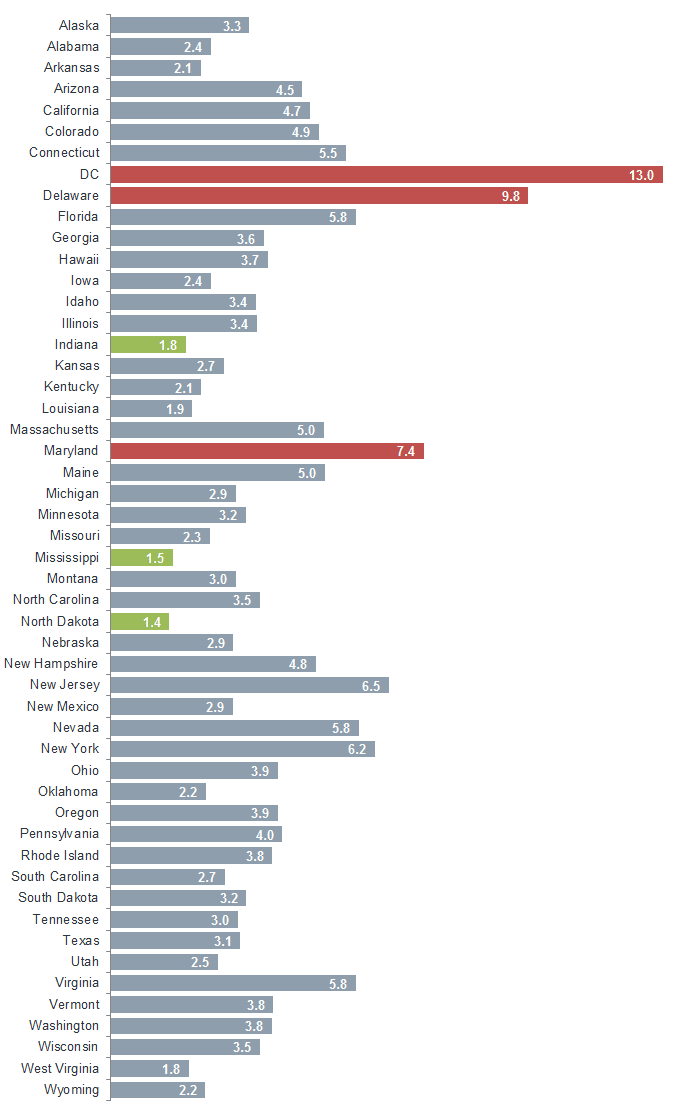

- Residents of Washington DC complained the most, with the highest complaints per capita (13 for every 100,000 residents), followed by Delaware (x per 100,000) and Maryland (7 per 100,000)

- The states with people least likely to complain where North Dakota, Mississippi and Indiana

Measuring Client Satisfaction With Their Credit Card Visitor

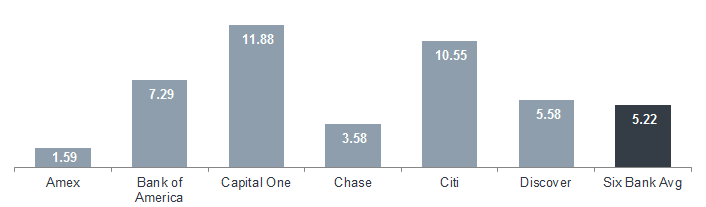

To make up one's mind which company had the near satisfied cardholders, nosotros looked at how many complaints the six largest credit bill of fare companies received compared to the volume of business organisation charged on their cards. An issuer with happier customers would hypothetically generate a lower measure of complaints. We calculated this by measuring how many complaints each company's customers had per billion dollars spent with that company'southward credit cards, and and so ranked them confronting each other.

Based on this, American Express and Chase ranked as the all-time credit card companies, while Capital One and Citibank scored the lowest out of the 6 issuers. Amex and Chase had the happiest credit bill of fare customers in 2013: for every billion dollars charged on their cards, customers only complained 2 to 4 times, while at the Capital One and Citibank, there were most eleven to 12 complaints for the same amount of spending. Majuscule 1 and Citibank received well-nigh 4x as many complaints as Amex and Chase, and about twice the average of the six major credit carte companies.

Complaints Per Billion Dollars Charged

Here is the data behind the metric that we used to measure customer satisfaction. We determined the complaint percentage past dividing the 2013 complaints past the 2013 United states buy volume (dollars charged on their credit cards). The lower their complaint metric, the better their customer satisfaction.

| Company | U.S. Buy Book ($B) | Complaints | Complaint Metric |

|---|---|---|---|

| Amex | $637.0 | 1,014 | i.59 |

| Capital 1 | 186.ix | 2,221 | 11.88 |

| JPMorgan Hunt | 419.5 | 1,502 | 3.58 |

| Bank of America | 205.ix | 1,502 | 7.29 |

| Citibank | 240.0 | 2,532 | 10.55 |

| Find | 110.0 | 614 | five.58 |

| Six Depository financial institution Aggregate | 1,799.3 | 9,385 | 5.22 |

What Are Customers' Biggest Complaints nearly Each Credit Carte Company?

The primary grievance customers had with all the banks are around billing disputes - problems with credit card bills and payments. The 2d and tertiary biggest problems differed from issuer to issuer. Here are a few highlights among the top six credit card companies:

- The only time rewards appears in the top three problems of a bank is at American Express; it really makes up vi.3% of their full complaints, compared to 2.2% on average at the five other issuers

- Bank of America had the greatest percent of customers complaining about account closure treatment compared to the other five

- Nearly 1 in every 5 complaints at Citi and Chase was virtually a credit card nib - the highest two out of the pack

- Chase cardholders had the highest pct of complaints nearly APRs and fraud on their accounts, with Discover as a close second

- Discover was the best with billing issues: it had the lowest percentage of billing issues compared to the other v

- American Express's credit cards got the everyman pct of complaints on identity theft / fraud / embezzlement

Top Three Complaints past Credit Card Company

| Amex | Uppercase One | Chase | Banking company of America | Citi | Discover |

|---|---|---|---|---|---|

| Billing Disputes | Billing Disputes | Billing Disputes | Billing Disputes | Billing Disputes | Billing Disputes |

| Account Closure | Fraud | APR or Interest Rate | Account Closure | Apr or Interest Rate | Apr or Interest Rate |

| Rewards | Business relationship Closure | Fraud | Fraud | Account Closure | Fraud |

Fraud encompasses identity theft, and embezzlement. Business relationship closure encompasses problems with account closings and cancellations. Annotation that we accept excluded the category "Other" where applicable to focus on identifiable problems.

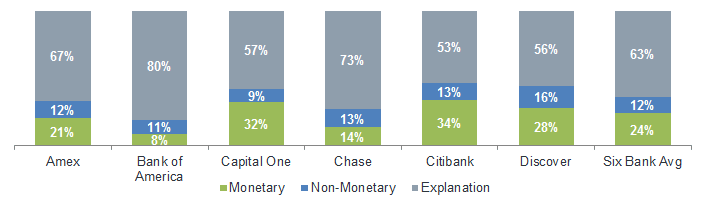

How Did Credit Card Companies Address Client Complaints?

Resolutions typically fall into three categories: explanations, monetary relief, and non-monetary relief. As nice as information technology is to understand the reason backside each issue, cardholders would probably prefer some monetary relief, such as a refund. So let'south take a wait at the breakdown of issue resolutions by issuer.

Citibank was the all-time credit bill of fare company for resolving complaints with cash back to their cardholders. 34% of complaints logged with the CFPB about Citibank were airtight with a refund back to its cardmembers, compared to 24% amid the six largest companies. Capital 1 was a close 2nd, with virtually a third getting some monetary relief. As our study reported before, Capital 1 and Citibank ranked as the top two well-nigh complained about credit card companies, so it's overnice to know that their customers are seeing the highest rates of recompense too.

On the other hand, Bank of America had the lowest rates of refunding cash to their cardmembers for CFPB complaints: at 8%, it was the but issuer with rates in the single digits. Its primary mode of resolution was providing cardholders with explanations, which comprised a meaning majority (eighty%) of its cases. Chase addressed 14% of its complaints with monetary relief, which was nearly twice the rate of Banking company of America's.

The CFPB reports that the median amount of monetary relief for credit cardholders was $125, while the most frequent refund was $25.

Credit Card Complaint Resolutions by Issuer

In this graph, we excluded cases where complaints were simply marked "Closed" with no further particular on the manner of resolution.

What kinds of complaints are the most likely to become consumers refunds? Belatedly fees generally have the best chances for getting refunded or receiving some other financial relief. Not bad news for Majuscule One, Citi, and Chase cardmembers: these three companies were the near lenient when it came to reversing belatedly fees. They had the best rates of refunds when cardmembers protested about late fees of 81%, 79%, and 57%, respectively. Good luck at Bank of America, which had the lowest cash relief rate of 21%.

Equally we mentioned before, the biggest issue consumers had with their credit carte companies was billing disputes. Our six major credit carte companies received almost 1,800 complaints in this category, out of which 36% of customers were able to get some money back. Discover (54%), Capital One (47%), and Citibank (47%) were the almost likely to reimburse their cardmembers for this category of complaint.

Credit determination gets yous nada in terms of monetary relief. Bankruptcy and privacy are the side by side two most frequent. These are three problems that customers may not find worthwhile to submit to the CFPB most if they are looking for refunds or other financial consideration.

Which Complaints Are Most Probable to Go Refunds at Your Carte Company?

Here are the categories by credit card company that saw the most or to the lowest degree monetary relief. Numbers refer to the percent of those complaints that received monetary consideration. Note that where applicable nosotros have excluded the "Other" category to focus on specific problems.

| Most Likely | Least Likely | |||

|---|---|---|---|---|

| Amex | Late fee | 45.seven% | Application processing filibuster | 0.0% |

| Unsolicited issuance of credit card | 42.nine% | Bankruptcy | 0.0% | |

| Transaction consequence | 36.8% | Privacy | 0.0% | |

| Banking company of America | Balance transfer | 27.8% | Credit determination | 0.0% |

| Billing argument | 22.seven% | Collection practices | 0.0% | |

| Late fee | 21.two% | Abstinence / Workout plans | 0.0% | |

| Uppercase One | Late fee | eighty.7% | Bankruptcy | 0.0% |

| Greenbacks advance fee | 75.0% | Remainder transfer fee | 0.0% | |

| Cash advance | 60.0% | Credit determination | 1.half-dozen% | |

| Chase | Belatedly fee | 56.eight% | Credit determination | 0.0% |

| Billing statement | 32.1% | Defalcation | 0.0% | |

| Transaction issue | 29.4% | Privacy | 0.0% |

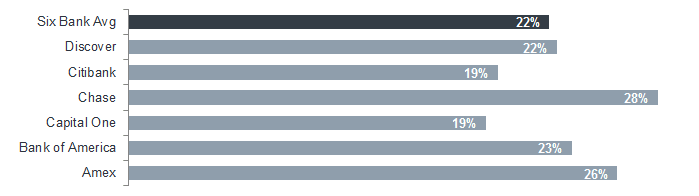

Were Customers Happy with How Their Complaints Were Resolved?

How satisfied were complainants with their credit card companies' responses? We'll await at how many consumers disputed their case resolution as a measure out of satisfaction.

While all issuers addressed and airtight their complaints in 2013, a subsequent 21% of the cases were disputed by their cardholders. Capital 1 and Citibank cardholders were the happiest. They were the to the lowest degree probable to dispute their closed complaints out of the major companies. On the other hand, Hunt and American Express saw the most customers contesting their closed cases as a per centum of full complaints. No further particular is bachelor near the conclusion of these cases.

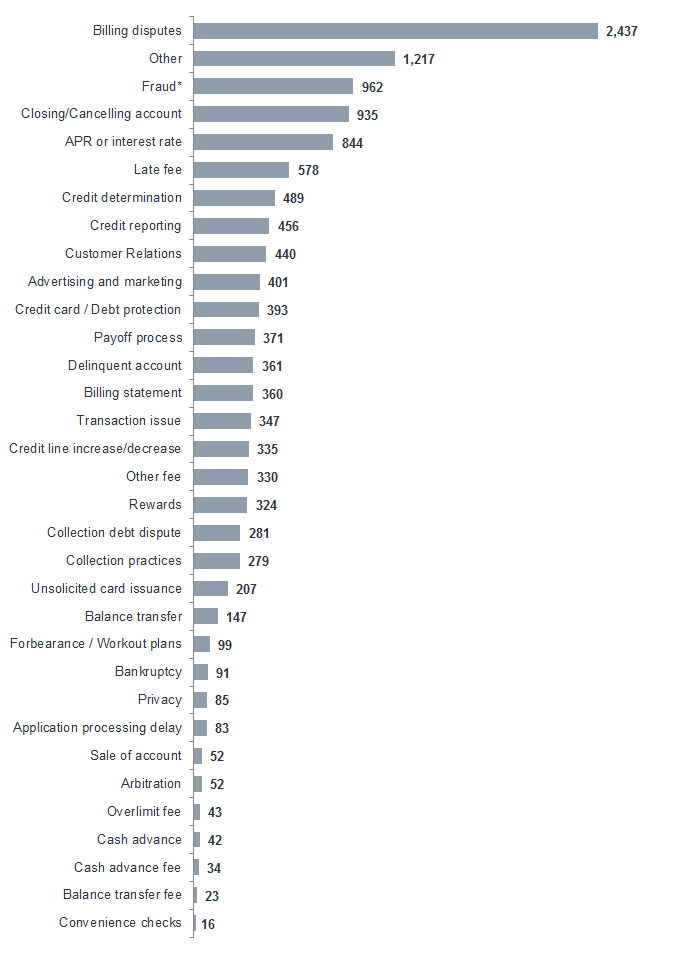

What are Cardholders Unhappy near?

The superlative three issues that credit cardholders complained the well-nigh about were billing disputes, identity theft / fraud / embezzlement, and account closing / cancellations. These categories fabricated up nearly a 3rd of all submissions to credit menu issuers and affiliates. While a category of "Other" constituted 9.3% of total complaints, no farther detail was bachelor from the CFPB data. When aggregated, credit card fees made upward seven.vii% of all complaints. This would have ranked fees as the second most identified issue among cardholders. The biggest type of fee that most customers complained about were tardily fees, which fabricated upwards more than half of fee-based complaints.

Fraud includes identity theft and embezzlement

Is It Worth It to Complain to the CFPB about Your Credit Card Result?

Chances are consumers already contacted their credit card companies offset about the effect, and received an caption or unsatisfactory handling. Past taking the actress step of formally complaining to the CFPB, nosotros assume that they're looking for additional action, such as a refund or some other financial consideration.

Complaints that were closed with refunds had a median dollar amount of $125, with the well-nigh frequent refund being $25. It tin be worthwhile for a few minutes of time on the CFPB'southward website.

So which bug will get you the best chances? We'll calculate the success rate of each category in getting monetary relief to determine which bug are nigh worth consumers' while to complain virtually.

In full general, the most worthwhile category to complain to the CFPB nigh is fees. Late fees, in detail, see a high caste of fiscal relief where 63% of consumers emerged with refunds or reductions. Billing disputes, the largest category of complaints, see the fifth highest fiscal relief rate in the industry of 37%. These rates differ by credit carte du jour visitor - for example, your chances with refunds at Majuscule 1 and Citibank for credit card late fees are much higher at 81% and 79%, respectively.

Here are the chances that complaining to the CFPB will go you financial relief for certain issues:

- 50/50 and better: Late fee, Other credit carte du jour fees (fees not already identified individually)

- 2 in 5 chance: Overlimit fee, greenbacks advance fee

- 1 in 3 chance: Credit carte du jour and debt protection, Balance transfer fees, Billing argument

- 25% chance: Residue transfer, April or interest charge per unit

Don't bother contacting the CFPB for credit-related complaints if what yous're looking for is financial consideration. Whether you're objecting to credit determinations, or increases or decreases to limits, these categories typically get addressed with explanations. Unfortunately, ane category that gets minimal fiscal relief is perhaps comprised of those consumers who demand information technology the well-nigh: bankruptcy complaints.

Resolutions by Complaint Category

Fraud includes identity theft and embezzlement

Who Complained the Most?

Nosotros also looked at complaints by states in the continental U.S. to run across where credit cardholders were calling in issues from. The CFPB received 4.i complaints per 100,000 residents beyond America for all credit card companies. The meridian 3 states with the most dissatisfied cardmembers were Washington, DC; Delaware, and Maryland. These Mid-Atlantic states averaged 8 complaints per 100,000 residents. The happiest states with the least complaints past this measure were: North Dakota, Mississippi, and Indiana.

Complaints per Capita by Country

Data is presented as number of complaints per 100,000 residents in land:

Other Statistics on Complaint Submissions

61% of users submitted their complaints through the CFPB'southward complaint web portal, while xix% came through every bit referrals from other regulatory agencies. Traditional media channels - postal post, telephone, and fax - made up about a fifth of all remaining user submissions, while 15 cardholders emailed their complaints through.

Once submitted, complaints are turned around reasonably quickly. More 80% of complaints become forwarded to the company in question in three days or less - most make it to the company in the same mean solar day they were received (xl%). Only 6% of complaints accept longer than a week. Of this subset, 31 complaints waited more than 100 days before being forwarded to credit carte companies for response, with the longest turnaround being 224 days.

Source: Consumer Financial Protection Bureau 2013 Credit Carte du jour Complaints database

Where To File Comlaints Against A Credit Card Companys Poor Customer Service,

Source: https://www.valuepenguin.com/credit-card-complaints-study

Posted by: artisrejast1963.blogspot.com

0 Response to "Where To File Comlaints Against A Credit Card Companys Poor Customer Service"

Post a Comment